The Inflation Reduction Act (IRA), passed in 2022, is transforming the U.S. solar industry in 2025 by accelerating domestic manufacturing, strengthening supply chains, and driving clean energy growth. With generous tax credits and incentives, the IRA is positioning the U.S. as a global leader in renewable energy production.

Boost to Domestic Manufacturing:

One of the most significant impacts of the IRA is the revival of solar panel and component manufacturing in the U.S. The Act provides production tax credits for solar modules, cells, wafers, and polysilicon, encouraging companies to set up factories domestically. This not only reduces reliance on imports but also creates thousands of jobs in states like Texas, Ohio, and Georgia.

Strengthening Supply Chains:

The IRA is helping mitigate supply chain risks by promoting local sourcing and vertical integration. By incentivizing the entire solar value chain, from raw materials to finished panels, it ensures stability, lowers costs over time, and supports energy security.

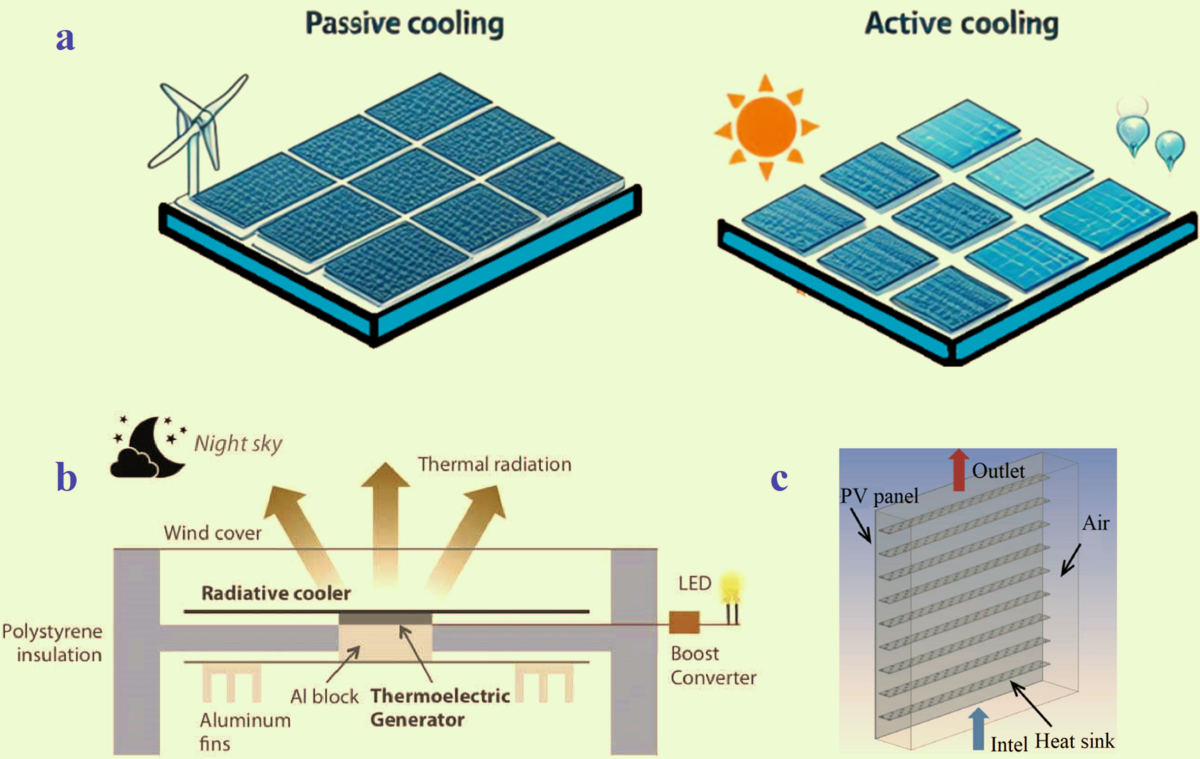

Driving Innovation and Investment:

Investors are showing renewed confidence in the solar sector. Federal incentives are attracting billions in private capital for advanced technologies like thin-film panels, perovskite solar cells, and energy storage integration. This innovation wave is enhancing efficiency and competitiveness in global markets.

Sustainability and Net-Zero Goals:

By fostering domestic solar growth, the IRA directly supports U.S. climate targets. Expanded manufacturing capacity ensures faster deployment of clean energy projects, reducing carbon emissions and helping achieve the national goal of a 100% clean electricity grid by 2035.

The Inflation Reduction Act is more than a policy, it’s a catalyst reshaping U.S. solar manufacturing. By creating jobs, securing supply chains, and driving innovation, it is laying the foundation for a resilient and sustainable clean energy future.