India’s solar sector is evolving rapidly, driven by the twin pressures of climate goals and energy security. In fiscal year 2025, India added around 23.8 GW of new solar capacity (utility-scale, rooftop, and off-grid combined), marking a nearly 58.5% year-on-year increase over FY2024.

This expansion is pushing both deployment and innovation in solar panel technology.

One of the key recent advances is in high-wattage module production. For example, Avaada Electro’s Butibori plant in Maharashtra is producing 720 Wp TOPCon modules with large 220×220 mm G12 cells. This marks a shift toward higher module power in smaller form factors, improving power output per square metre.

Another major trend is the development of tandem solar cells, especially Silicon-Perovskite tandem architectures. In mid-2025, IIT Bombay researchers built a perovskite-silicon tandem cell achieving 29.14% efficiency using a 4-terminal (4T) configuration, combining an optimized low-bandgap inverted top cell with a silicon bottom cell.

Such tandem designs promise greater spectral capture and higher theoretical ceilings beyond traditional single-junction silicon cells.

Perovskite single-junction modules are also advancing in India. A young startup, P3C Technology and Solutions (IIT-BHU spinoff), is testing perovskite modules (~30 cm²) with 15% efficiency, while undergoing durability and reliability verification via the National Institute of Solar Energy (NISE).

At the same time, IIT Bombay’s work on bifacial perovskite solar cells shows how optimal tilt angles (≈20°) and enhanced rear-side albedo (≈0.5) deliver increases in efficiency (from ~17.5% to ~18.8%) and high bifaciality factors.

PV Magazine India

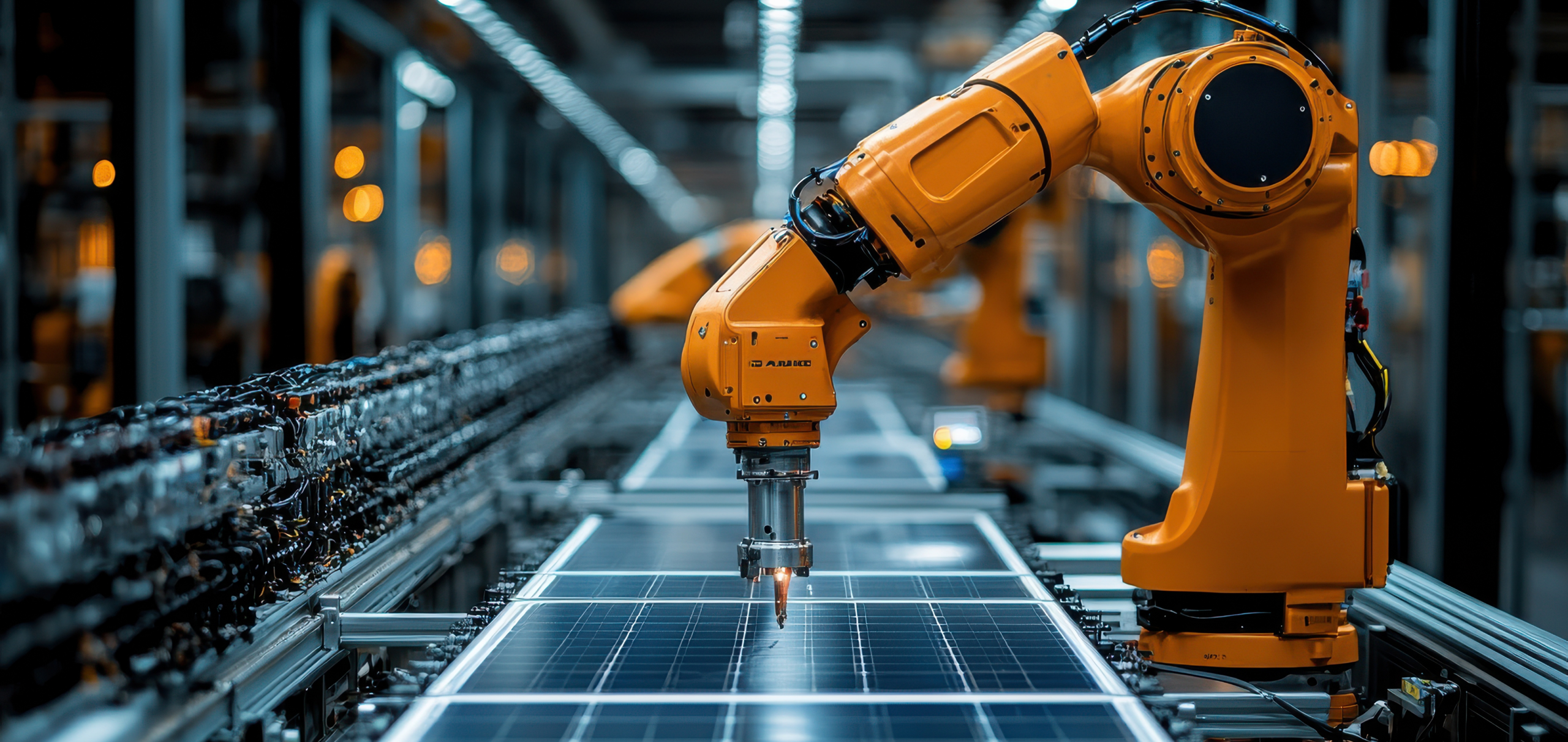

India is also pushing to localize solar component manufacturing, not just module assembly. Adani Group has begun commercial production of wafers and ingots. The target is to produce polysilicon domestically by 2027-28, so India can become a fully integrated solar supply-chain player.

Associated with that, new policies are being introduced: from June 2026, clean-energy projects in India must use solar PV modules built from locally-produced cells.

On the module types front, TOPCon (Tunnel Oxide Passivated Contact) modules are gaining favour because of their higher efficiency and better degradation profiles compared to older PERC technologies. The shift to larger cell sizes (G12, etc.) helps reduce inter-cell losses and improve cost per watt. The Avaada example echoes this trend.

In research labs, innovations around indium zinc oxide (IZO) for transparent back contacts, better transport layers, and passivation layers such as aluminum oxide (Al₂O₃) are helping perovskite and tandem devices overcome interface losses and stability problems.

Indoor photovoltaic and bifacial designs also show promise: IIT-Mandi, NISE, and partner institutions have demonstrated indoor bifacial perovskite photovoltaics (i-BPPVs) reaching ~30.3% efficiency under LED lighting (~1000 lux), useful for small-scale, indoor, or off-grid applications.

From a policy and market perspective, India’s goals are ambitious: industry bodies expect module manufacturing capacity to rise materially by 2030 (e.g., from ~80 GW today to ~160 GW), along with matching growth in solar cell, wafer, and polysilicon capabilities.

Government tender mandates, import rules, and Approved List of Models & Manufacturers (ALMM) frameworks are helping steer these changes.

Challenges remain: stability of perovskite under prolonged exposure, scaling tandem cells from lab to large area modules, supply of high-quality materials (e.g., transparent conductors, non-toxic transport layers), and ensuring cost-competitiveness as module prices drop. But the pace of research and industry investment suggests those gaps are narrowing.

In conclusion, India is now entering a phase where solar panel technology is not only about scaling up capacity but also about pushing the frontiers: higher efficiencies (through tandem cells), larger modules with lower cost per watt, localizing critical supply chain elements, and exploring new materials like perovskites and bifacial designs. For stakeholders, manufacturers, developers, and policymakers, aligning with these trends will be essential to achieving the 500 GW non-fossil energy target by 2030 and India’s net-zero goals.